Unlock the Possibilities: Your Key to the Private Market and Beyond

With our innovative investment solutions, you can diversify your portfolio, mitigate risks, and capitalize on the exclusive opportunities that the private market has to offer. Join us and discover the future of investing today.

Why Invest in Private Markets?

Investing in private markets offers unique advantages that can significantly enhance your investment portfolio. Here’s why you should consider private market investments:

High Potential Return

Private equity has historically outperformed public markets over long periods. By investing in companies before they go public, you gain access to substantial growth potential that is often realized during their transition to the public market. This can result in significant returns on your investment.

Value Creation

Investing in private companies allows you to be part of their growth journey from an earlier stage. Private market investments support innovation and expansion, contributing to value creation. As these companies develop and reach their exit events, such as IPOs or acquisitions, they generate value for their investors.

Diversification

Adding private market investments to your portfolio provides diversification, reducing your overall risk. These investments are not correlated with the public markets, meaning they can perform well even when public markets are volatile. Diversifying with private equity can help achieve better risk-adjusted returns.

Access to Exclusive Opportunities

Investing in private markets provides access to exclusive opportunities not available in public markets. By investing in high-potential pre-IPO companies, you gain entry to unique deals and early-stage investments that can lead to significant returns. This early access allows you to participate in the growth of innovative companies and capitalize on their success before they go public.

AMP Investment Solutions

-

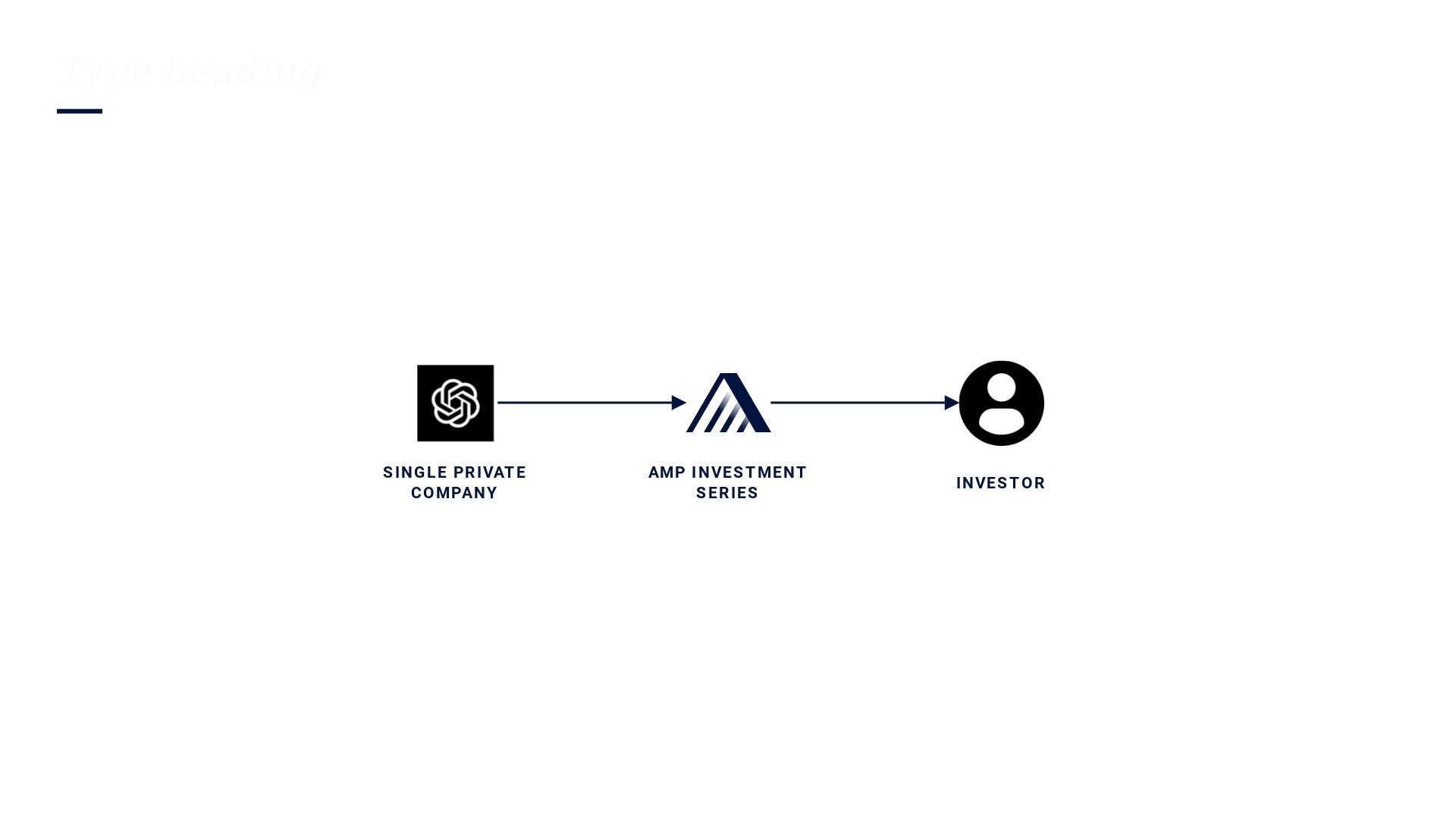

Single Company Series

Invest directly in a promising private company, gaining focused exposure and the potential for significant influence and returns.

-

Multi-Company Funds

Diversify your holdings with a sector-agnostic portfolio of private companies, balancing risk across various industries and growth stages.

-

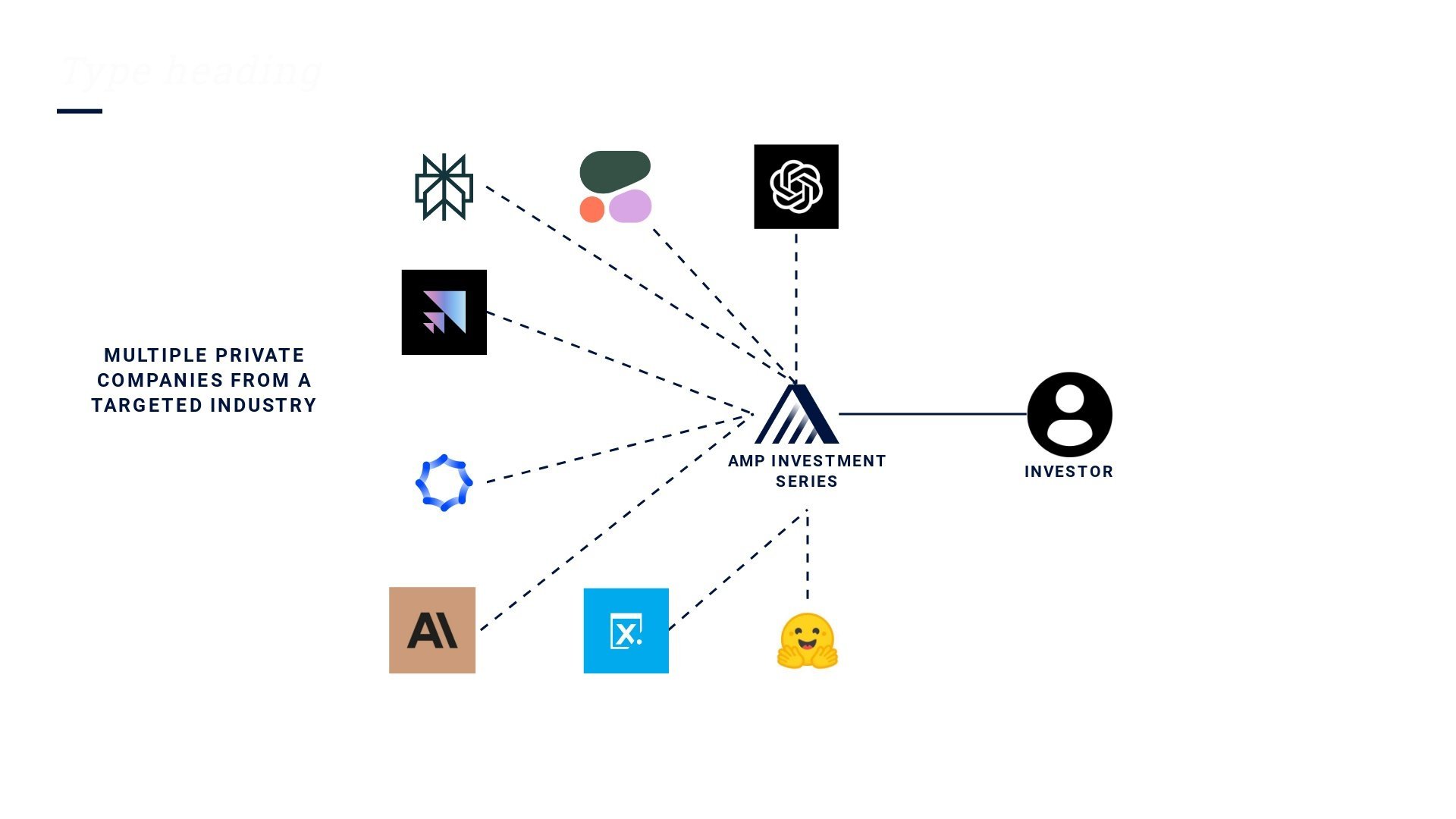

Thematic Funds

Concentrate your investments in specific high-growth sectors such as AI or FinTech, capitalizing on targeted industry trends and advancements.

Coming Soon: Our Innovative Investment Platform

Get Ready for a New Era of Investing

Seamless Account Management

Effortlessly manage your investments with an intuitive interface that simplifies everything from account setup to portfolio tracking.

Real-Time Data and Analytics

Stay ahead of the market with access to real-time data, analytics, and insights that empower you to make informed investment decisions.

Enhanced Due Diligence

Benefit from comprehensive due diligence tools and resources that provide in-depth analysis and strategic insights into every investment opportunity.

Exclusive Investment Opportunities

Gain early access to high-potential pre-IPO companies and exclusive deals that are meticulously vetted by our expert team.

Powerful Features

User-Friendly Experience

Enjoy a streamlined and user-friendly experience, designed to make your investment journey as smooth and efficient as possible.

Integrated Communication Tools

Easily connect with our support team and other investors through integrated communication features that keep you informed and engaged.

.jpeg)

.png)