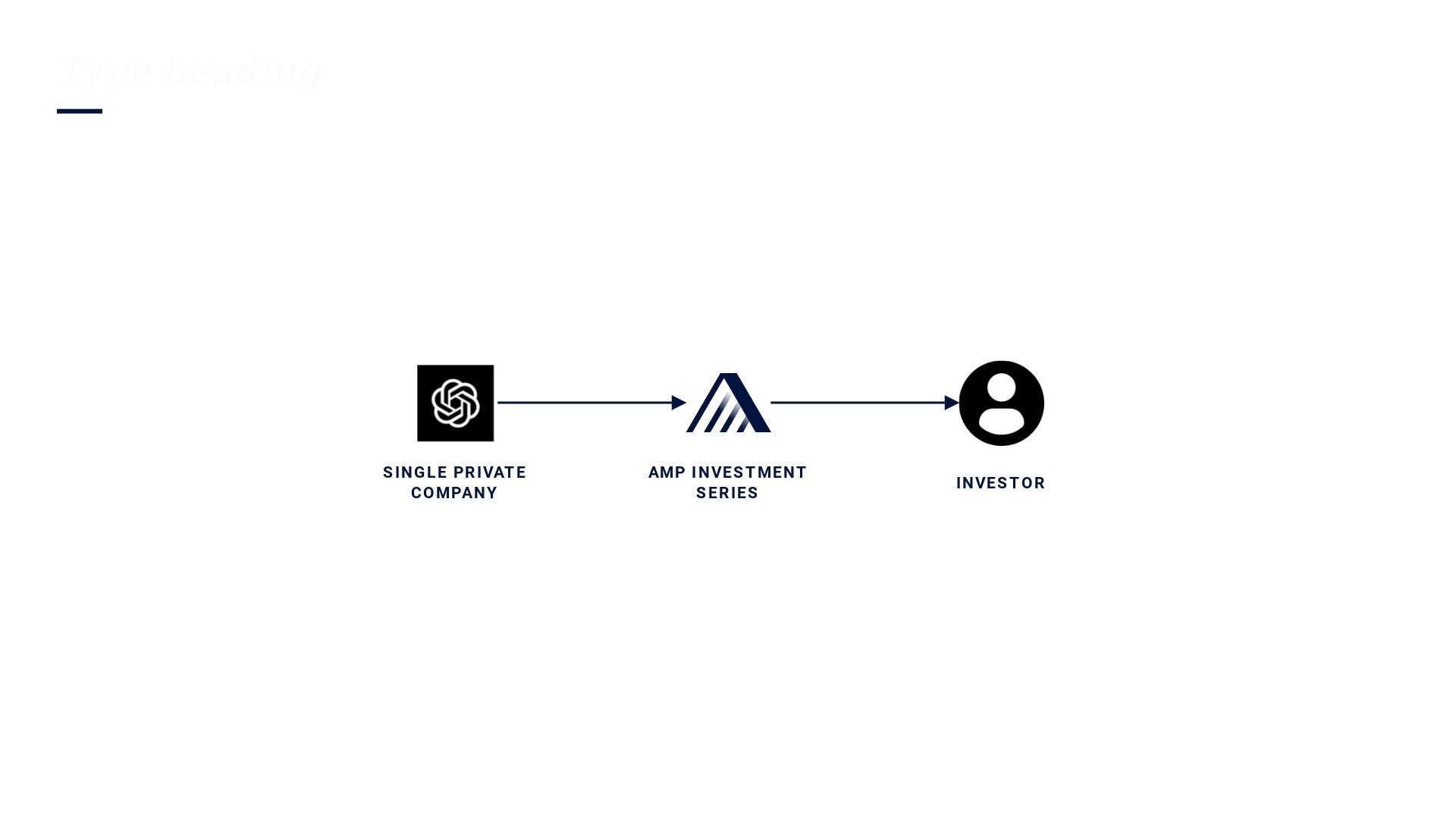

Single-Company Funds

Invest in a single company via a single series SPV

How it Works

At Ace Management Partners, we first gauge demand from interested investors on a specific company. If there is sufficient interest, we proceed by reaching out to the seller (typically a former employee or investor needing liquidity) through our service provider.

We then negotiate a purchase through the newly formed fund series, believed to be of fair value. Subscription agreements are then sent to interested parties and accepted into the fund. Each member of the series receives a 1:1 ratio of stock per capital commitment. This process ensures that our investors gain access to high-potential pre-IPO companies with a structured and strategic approach.

Benefits of Single-Company Funds

Investing in single-company funds can offer several potential benefits to investors:

High growth potential: Pre-IPO companies are often in their early stages of development and may have significant growth potential. If the company succeeds, investors can potentially realize substantial returns when the company goes public or is acquired. In a single-company series, you also are not exposed to the risk or returns of any other fund series.

More control over investment decisions: Investors can thoroughly research and select the specific company they believe has the best prospects, aligning with their investment thesis.

Potential for lower valuations: In some cases, pre-IPO companies may be valued lower than they would be in public markets, providing investors with the opportunity to invest at more attractive valuations.

Longer-term investment horizon: Pre-IPO investments typically have a longer investment horizon, which can align well with the objectives of patient, long-term investors.