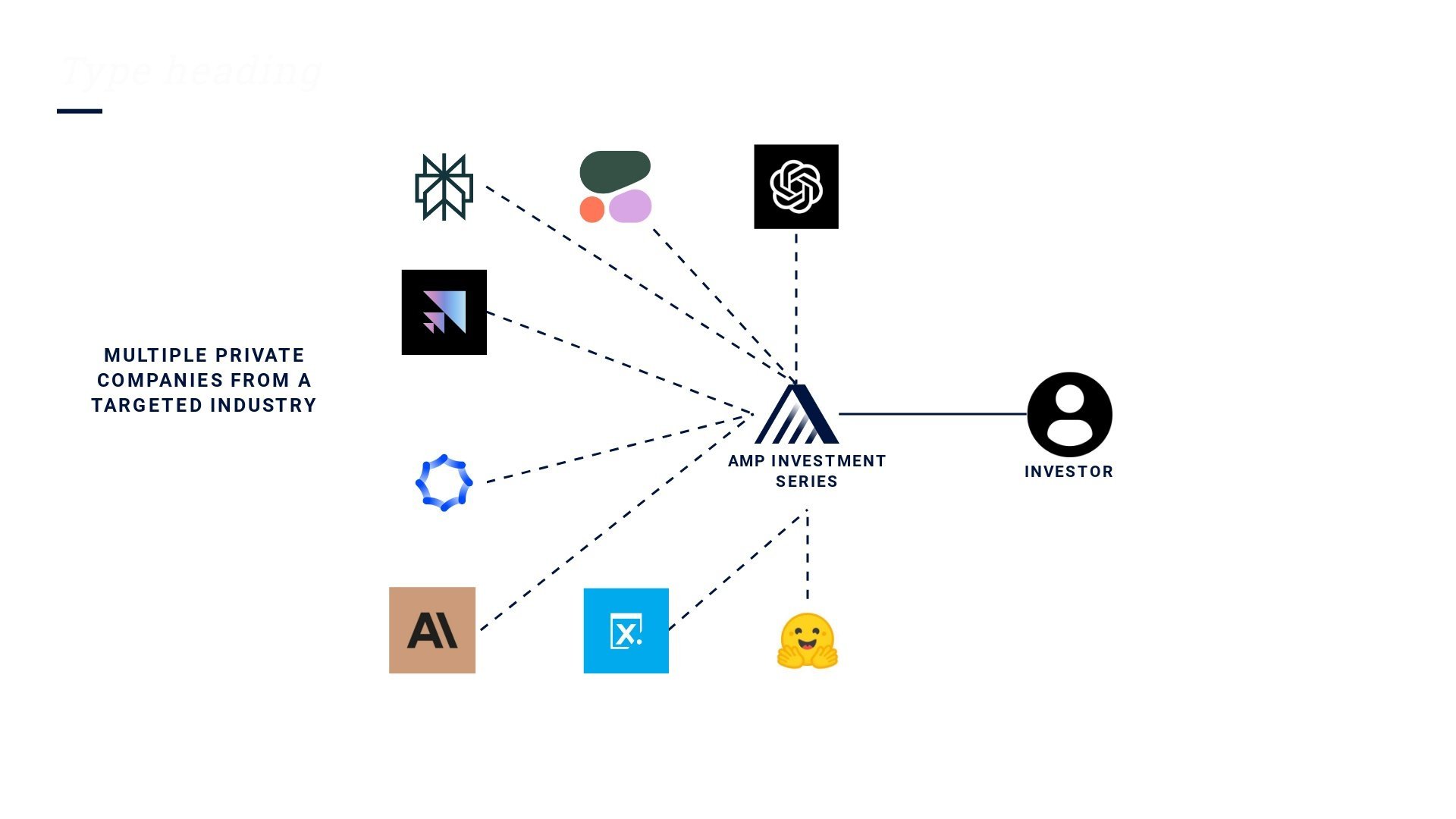

Thematic Funds

Invest into a portfolio of multiple companies from a rapdily growing industry with one fund investment.

How it Works

Our Thematic Funds offer investors a targeted investment approach by focusing on specific industries or sectors with strong growth potential. Our experienced fund managers conduct in-depth research to identify themes with favorable market dynamics, regulatory support, and technological advancements. By investing in a curated portfolio of companies that are leaders or innovators within these targeted themes, the funds aim to capitalize on the unique opportunities and growth drivers within each sector.

Benefits of Thematic Funds

Investing in thematic funds can offer several potential benefits to investors:

Targeted Exposure: Thematic Funds provide investors with focused exposure to specific themes, allowing them to align their investments with their interests and convictions in sectors with significant growth potential.

Expert Fund Management: Our fund managers bring deep industry expertise and knowledge to identify key trends, assess company fundamentals, and construct portfolios that capture the most promising opportunities within each theme.

Growth Potential: By investing in themes with strong tailwinds and market dynamics, Thematic Funds aim to capitalize on the growth potential of companies at the forefront of these trends, potentially leading to above-market returns.

Diversification: While Thematic Funds focus on specific sectors, they provide diversification benefits by investing in multiple companies within each theme, reducing the impact of any single company's performance on the overall portfolio.

Long-Term Perspective: Our Thematic Funds adopt a long-term investment horizon, identifying themes that are expected to play out over an extended period, allowing investors to participate in the structural shifts and transformative changes within these sectors.

Simplified Investor Onboarding

Thematic Fund Examples

Note: The following charts and allocations are samples for illustrative purposes only, and do not represent actual investment vehicles or investments held by any Ace Affiliates.

Summary: The AI thematic fund focuses on leading AI startups driving innovation in artificial intelligence and machine learning. The majority of the allocation is directed towards industry leaders and innovative companies like OpenAI, Anthropic, and Scale AI, aiming to balance high returns with diversification and risk management.

Summary: The Aerospace & Defense Fund focuses on the rapidly advancing aerospace and defense sectors. The majority of the allocation is directed towards industry leaders and innovative companies like SpaceX, Anduril, and Relativity Space, aiming to balance high returns with diversification and risk management.

Summary: The Data/AI Fund focuses on companies driving innovation in data analytics and artificial intelligence. The majority of the allocation is directed towards industry leaders and innovative companies like Databricks, Dataminr, and Cohesity, aiming to balance high returns with diversification and risk management.

Summary: The Fintech/Cryptocurrency Fund targets the cryptocurrency sector, with a focus on security, compliance, and innovative trading platforms. The majority of the allocation is directed towards industry leaders and innovative companies like Kraken, Chainalysis, and Blockstream, aiming to balance high returns with diversification and risk management.

Interested in learning more?

Fill out the form below and a member of our team will reach out to you.