Multi-Company Funds

Gain exposure to 5-10 unicorn companies in one fund investment

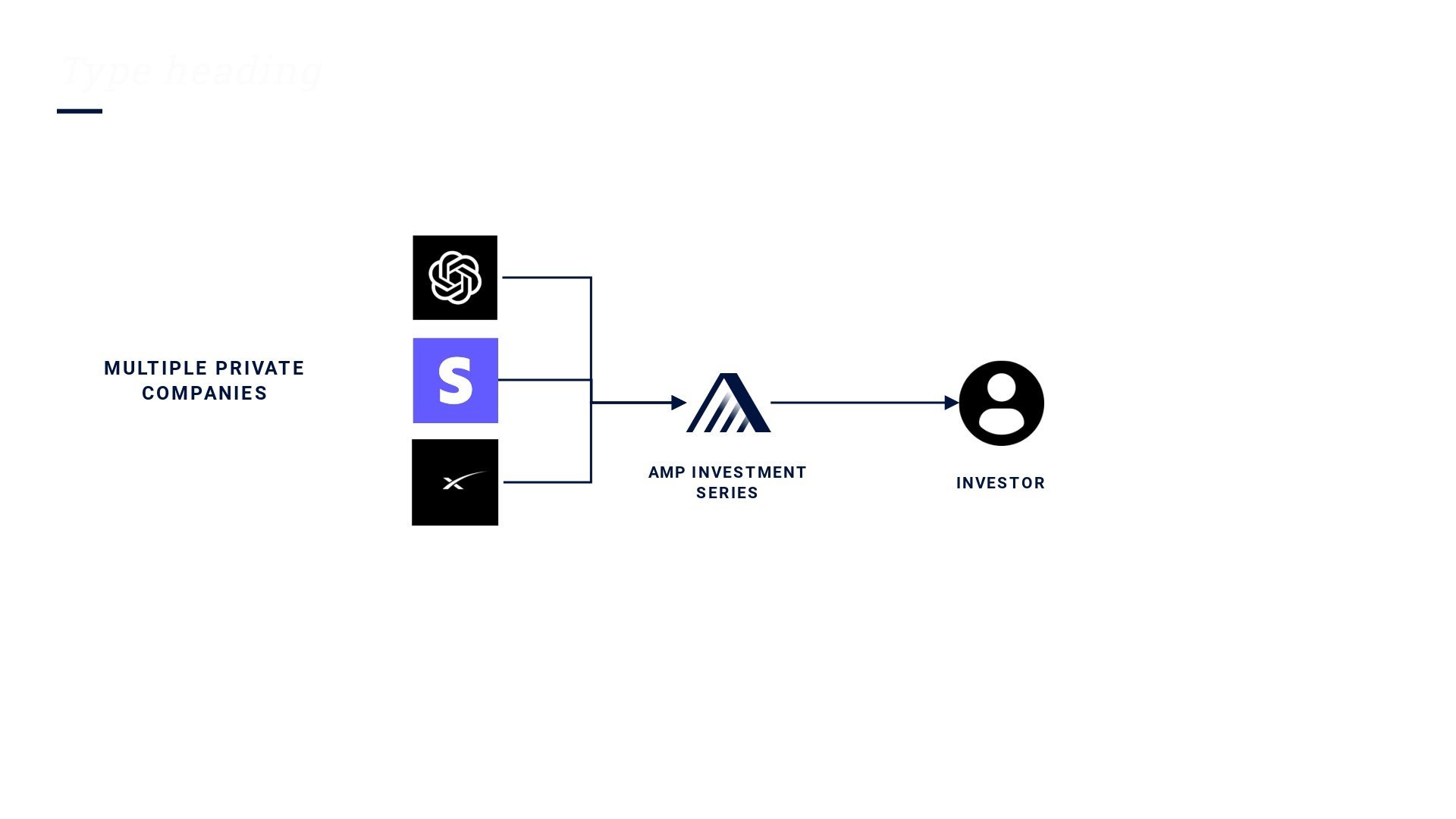

How it Works

Multi-Company Funds offer a diversified investment approach by allocating capital across 5-10 high-potential pre-IPO companies. Our experienced fund managers conduct extensive due diligence to select companies based on factors such as expected liquidity timeline, sector performance, future outlook, and numerous other criteria. By strategically distributing investments among multiple companies, the fund aims to mitigate risk while capitalizing on the growth potential of promising pre-IPO opportunities.

Benefits of Multi-Company Funds

Investing in multi-company funds can offer several potential benefits to investors:

Diversification: By investing in several pre-IPO companies, Multi-Company Funds spread risk across various sectors and businesses, reducing the impact of any single company's performance on the overall portfolio.

Access to Pre-IPO Opportunities: Multi-Company Funds provide investors with access to high-growth pre-IPO companies that may not be available through traditional investment channels, enabling them to participate in potential early-stage growth.

Professional Management: Fund managers bring extensive expertise and experience to the investment process, conducting thorough due diligence and actively managing the portfolio to maximize returns while mitigating risk

Potential for Higher Returns: Pre-IPO companies often have significant growth potential, and Multi-Company Funds aim to capture this upside by investing in carefully selected businesses before they go public.

Flexibility: Multi-Company Funds offer investors the flexibility to invest in a diversified portfolio of pre-IPO companies without the need to individually research and invest in each company separately.

Reduced Volatility: By diversifying across multiple companies and sectors, Multi-Company Funds can potentially reduce the overall volatility of an investor's portfolio compared to investing in a single pre-IPO company.

Liquidity Management: Fund managers actively manage the fund's liquidity, considering the expected timeline for each company's liquidity event and ensuring that investors can realize returns within a reasonable timeframe.

Simplified Investor Onboarding

Multi-Company Fund Examples

Note: The following charts and allocations are samples for illustrative purposes only, and do not represent actual investment vehicles or investments held by any Ace Affiliates.

Summary: The allocation for Fund One focuses on high-growth potential sectors such as aerospace/defense, fintech, AI, logistics, SaaS, foodtech, and cybersecurity. The majority of the allocation is directed towards industry leaders and innovative companies like SpaceX, Kraken, and Databricks, aiming to balance high returns with diversification and risk management.

Summary: Fund Three targets emerging technologies and high-growth sectors. The allocation includes a mix of aerospace/defense, fintech, AI, logistics, SaaS, and foodtech companies. Notable investments in Relativity Space, Blockstream, and Dataminr highlight the focus on companies with significant growth potential and technological advancements.

Summary: Fund Two emphasizes investments in companies with strong technological capabilities and market potential. The allocation prioritizes sectors like aerospace/defense, fintech, AI, logistics, SaaS, and cybersecurity. Companies like Anduril, Chainalysis, and Cohesity are included to leverage their innovative solutions and market leadership.

Summary: Fund Four is designed to capitalize on advanced technology and sustainable growth sectors. Major investments are made in aerospace/defense, fintech, AI, logistics, data management, and cybersecurity. Companies like SpaceX, Stripe, and OpenAI are chosen for their industry leadership and innovation, aiming to deliver robust returns while managing risk.

Interested in learning more?

Fill out the form below and a member of our team will reach out to you.